(updated Aug 17, 2016 - originally published Feb 1, 2016)

Bad Public Policy

The $11 Million investment of public funds by Village of Lisle to build a college stadium will be sold to BU in 2029 for ONE DOLLAR.

$11 Million = total principal and interest paid from 2004-2033.

$1 = contract sales price transfer 100% ownership to BU 2029.

$1 = contract sales price transfer 100% ownership to BU 2029.

In 2004, the Village of Lisle decided to borrow $6.42 Million to finance the construction of athletic facilities at a private university - namely, the Benedictine University Athletic Center.

The bonds were issued as "General Obligation Bond, Series 2004 (Alternative Revenue Source)."

The new alternative revenue source to pay the bond payments was a new 2% tax on Lisle hotels.

When/if the alternative revenue falls short, these bonds are backed by the property tax payers of the Village of Lisle - General Obligation Bonds.

The Village of Lisle taxpayers have no long-term ownership interest in the facility even though we are all on the hook financially backing the bonds with our property taxes if the hotel tax revenues fall short. The Village of Lisle taxpayers own the publicly-financed "improvements" until 2029 when we sell it, under an agreement approved in 2004, for ONE DOLLAR.

And hotel tax revenues are falling short. Very short.

The hotel outlook in Lisle is very concerning.

Back in 2004 when the Village Board approved borrowing millions for construction of these athletic facilities at a private university, it was billed as a "win-win" for Lisle. It would "PAY FOR ITSELF."

The project was sold as a public investment in a private facility that would generate a significant increase in tourism, hotel stays and spending in the Village.

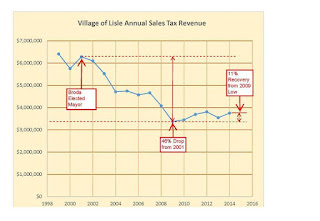

That did not happen - hotel revenue is down and sales tax revenue is down.

Individual Lisle residents and taxpayers can't use these private facilities.

BU entered into agreements with the Village and Lisle School District 202 to make the facilities available for their use.

"The project essentially can pay for itself through naming rights and other revenues created by the stadium," - IL Sen Michael Connelly.

BU Athletic Complex Original Bond Payment Schedule

General Obligation Bond, Series 2004 (Alternate Revenue Source), payments are due in variable annual installments of $130,000 to $2,350,000 each January 1, with interest payable semiannually each January 1 and July 1 at 4.00% to 5.105% through January 1, 2024.

Projections Vs. Reality

Hotel tax revenues fall short

Hotel tax revenues to pay the annual 2004 BU Stadium Bond payments have fallen significantly short of the initial projections. Recent annual bond payments have been made by drawing down from the fund balance that accumulated back when hotel revenues exceeded the annual bond payment. The plan back in 2004 was to accumulate excess hotel tax revenue, invest it, and this would provide the funds necessary for the final balloon payment.

The following are the remaining bond payments

(Ref: Village of Lisle CAFR, FY ending April 30 2015):

Total remaining principal and interest = $6,483,320.

Bonds issued in 2004 = $6,420,000.

Principal Balance as of April 30, 2016 = $4,570,000 (4,815,000 - 245,000)

2016 Bond Issue (re-financed) = $3,700,000

2016 Pay-down of Principal prior to Re-financing = $4,570,000 - $3,700,000 = $870,000.

(paid from bond fund sinking fund)

BU pays no Property Tax

Under Illinois Property Tax Code, property that is "exclusively" used for charitable, educational or religious use is exempt from payment of property tax. BU has been leasing out the athletic facilities to for-profit professional teams - a use that is not charitable, educational or religious. Why local taxing bodies have not filed tax objections with the assessor and the state tax review board is mind-boggling.

Re-Financed Bonds

Unable to make the remaining bond payment, the Village of Lisle Board of Trustees reissued (re-financed) the remaining bond payments. The re-fi will significantly lower the annual payments of principal and interest and will extend the number of years of repayment to 2032.

Over the past 12 years, Benedictine University has contributed no net operating revenue to the bond fund. The Village chose not to audit BU Athletic operations to verify, on behalf of Lisle taxpayers, that the athletic facility financial losses were accurately reported.

With hotel tax revenues failing to recover from the 2008 recession and no other revenue source available, the Village was in a bind. Rather than publicly admit the failure of the BU Athletic Stadium Project, the Village spin is that this is all somehow "saving" taxpayers money.

How stupid do they think we are?

Reference Documents:

2004 Bond Payment Schedule:

Lisle 2% Pledged Hotel Tax Revenue - Actual vs. Projected

Lisle Sales Tax History:

Oct 16, 2015 FOIA for BU Bond Re-payment Plan

Transfer to BU for ONE DOLLAR:

No comments:

Post a Comment